With the World Cup started, let’s make a comparison about 2 neighbours countries: Spain and France.

They have already played 2 matches of the group stage. Both are in first position of their group, France with 2 victories and Spain with 1 victory and 1 draw.

Bookies say that Spain is more favourite than France:

Ok, but the comparison of today is not about their perfomance in the World Cup, is about their betting market.

As you probably know, both countries have regulated the online betting market. The main difference between them is the gambling tax (25% in Spain and 44% in France).

Let’s see what is the consequence of this difference in the gambling tax.

The stakes made in each country in 2017 are clear: 5,463 M€ in Spain vs 2,510 M€ in France. The double in Spain than in France, but if we look to the population of each country (46M in Spain vs 67M in France) the difference is bigger. The bets per habitant in Spain is 3 times bigger than in France (117.34€ vs. 37,51€ ).

However, the GGR of the companies operating in France is bigger than the ones operating in Spain (472 M€ in France vs 311 M€ in Spain). This is due to the great difference in the winning margin which is very low in Spain (5.70%) and very high in France (18.80%).

Checking at this numbers we could think that the French operators are doing their work very well and the Spanish ones, not so good. Or maybe that the Spanish bettors are smarter than the French people.

It’s not like that.

Let’s compare a operator which is operating in both territories: Bwin. We can imagine that Bwin is managing both territories in a very similar way.

Let’s see.

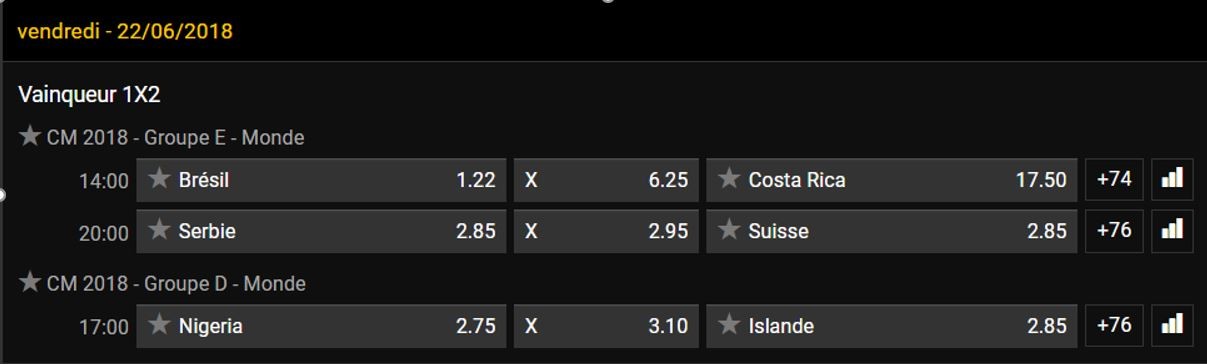

If we have a look on today’s matches of the World Cup, we can see that Bwin is offering 315 different markets for each match in Spain, and in France the users only have 75 markets.

*Bwin.fr and Bwin.es

Appart from the number of markets, the odds are very different too. Maybe not in the previous example (1X2) but if we take a look to other markets inside we will check this better.

The average overround in this market in Spain is 107.18%, quite acceptable for general bettors. In France thin margin is in 115.29%, unacepptable for a lot number of users.

So what conclusion could we make about this?

Yes, France have regulated the online betting market but with that gambling tax the operators are not able to show interesting odds.

The social (or amateur bettors) will continue betting in these operators but the pro users are forced to bet on abroad brands.

UK is very similar to France in population, and with a 15% gambling tax, the stakes made there are 10 times bigger than in France.

*UK numbers are from Oct 2016-Sep 2017

I think that the French regulator should recalculate this gambling tax in order to increase the competence of their operators, or even to attract more brands to its territory such as Bet365 for example.

Alex Zubizarreta

Latest posts by Alex Zubizarreta (see all)

- Bet on Trump… or not. - 7 September, 2018

- Esports Betting Market Size in Spain - 19 July, 2018

- Euskadi: Memoria de Juego 2017 - 9 July, 2018